canadian tax strategies for high income earners

We will begin by looking at the tax laws applicable to high-income earners. Thats important to understand because you might assume that high-income earners are.

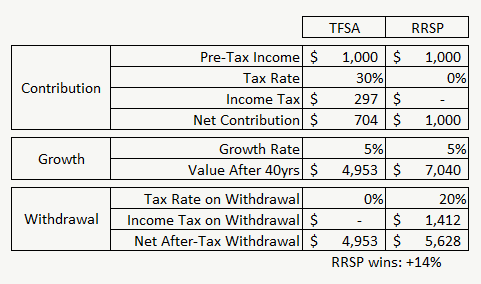

Tfsa Vs Rrsp How To Choose Between The Two Canadian Money Retirement Advice Crypto Money

These days it can seem like theres a tax on everything and with Canadas progressive tax system the more income you earn the higher your tax rate.

. RRSP withdrawals are taxed at your marginal tax rate. Invest in Qualified Opportunity Zones. We assist high-income earners with personal tax planning strategies and tax-efficient financial planning to deliver savings that enhance long-term wealth growth.

High-income earners must carefully consider their salary investment income and capital gains in a web to reveal how to pay their taxes every year when tax season rolls around. Uncovering tools to reduce taxes is in high-income earners best interest. Trusts can also help reduce state taxes on investment earnings.

Trusts can also help reduce your state income tax liability on investment earnings so while the Federal tax rate stays the same there are savings on state taxes. For many high-earning Canadians there may be specialized tax strategies that help preserve and grow their wealth. There are several income-splitting strategies that families can use to reduce their tax burden.

A great example of a safe tax-avoidance strategy is the RRSP Registered Retirement Savings Plans. Tax Planning Strategies For High-Income Canadians. Utilize RRSPs TFSAs RESPs to the max.

An overview of the tax rules for high-income earners. Most people think of insurance for their home their Auto and life. Using these strategies you can reduce your taxable income and make the most of your money from all sources.

If you face a high tax burden youll be interested in how you can reduce it or at least manage it. This is one of the most important tax strategies for you as a high-income earner. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts.

Tax Strategies for high-income earners. Tax Loss Harvesting for Recurring Tax Shields. When personal income exceeds 200000 in Canada the earner has to pay taxes at a rate of 50 or higher depending on the province of residence.

Contact a Fidelity Advisor. This article highlights a non-exhaustive list of tax minimization strategies to consider with your professional advisor. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000.

So you have to decide if its worth spending that for the other tax benefits Income-splitting and prescribed rate loans. You make contributions with after-tax dollars but the money can grow tax-free and withdrawals up to the amount of premiums paid are not taxed. Canadian Tax Tricks.

This is an important strategy for residents of high-income tax states with significant investment income. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. The use of these strategies will vary based on personal circumstance.

Total positive income is the sum of all positive amounts shown for different courses of income reported on an individual tax return. Instead your tax obligations may require a personalized guiding plan with annual tinkering and consultations with tax advisors as your wealth. Employer-based accounts such as 401 k and 403 b accounts allow you.

5 things to get right. One of best ways for high earners to save on taxes is to establish and fund retirement accounts. Using a loan at the prescribed rate mitigates the income attribution rules effectively splitting the investment income with the desired family members while also allowing you to retain control over the funds as they have not been transferred or gifted but rather were loaned.

The government is not against helping tax payers minimize their tax bills legally. Everyday tax strategies for Canadians. If youre a high-income Canadian there are tax minimization strategies that will help you reduce your tax burden.

Max Out Your Retirement Contributions. The change applies to high-income individuals who make additional contributions to a retirement program during a tax year. If you receive significant investment income and live in a high-income state these strategies can work well to reduce your tax liability.

The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax. The IRS defines a high-income earner as any taxpayer who reports 200000 or more in total positive income TPI on their tax return. Withdrawals get hit with a withholding tax that is paid upon withdrawal.

High-income earners make 170050 per year in gross income or 340100 if married or filing jointly. Just as your ambitions are uniquely your own so too is your tax situation. 9 Ways for High Earners to Reduce Taxable Income 2022 1.

This is one of the most popular tax deferral strategies for high-income earners because of higher limits that can be invested. Our experts are adept at reviewing current tax strategies and historical returns to ensure that clients pay only the appropriate amount of tax they owe. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax shelter is that its less flexible.

Lets start with retirement accounts. While this strategy is particularly effective for wealthier Canadians within the highest tax bracket there. There are numerous tax avoidance strategies which take advantage of rules offer generous tax breaks and are not frowned upon or illegal.

No single tax strategy will fit all scenarios. Sell Inherited Real Estate. One way is with insurance.

Tax Planning Strategies for High-Income Earners Offers a cost-effective way of funding permanent life insurance and accumulate wealth on a tax-advantaged basis without restricting the use of your cash flow and available capital. Split your income or pension with your spouse.

Money Architect Financial Planning Russell Sawatsky Understanding Canadian Tax Rates

Courage We Have Been Here Before

Earned A Small Amount Of Income Here S Why You Should Still File A Return H R Block Canada

Money Architect Financial Planning Russell Sawatsky Understanding Canadian Tax Rates

Earned A Small Amount Of Income Here S Why You Should Still File A Return H R Block Canada

Tax Saving Tips Canada 15 Secrets The Taxman Doesn T Want You To Know Part I Youtube

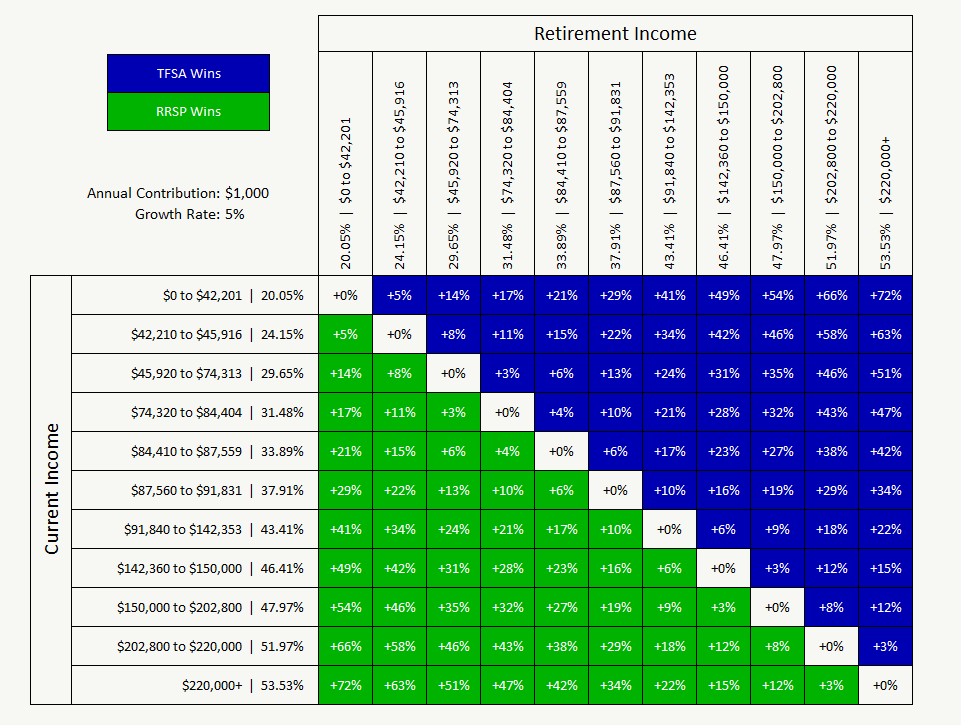

Tfsa Vs Rrsp Picking The Right One Could Save You 100 000 In Tax Planeasy

Kitces The Right Way To Prioritize Tax Preferenced Savings Strategies

Annual S P Sector Performance Novel Investor

Money Architect Financial Planning Russell Sawatsky Understanding Canadian Tax Rates

What Can You Claim On Your Income Taxes 7 Deductions Not To Miss Moneysense

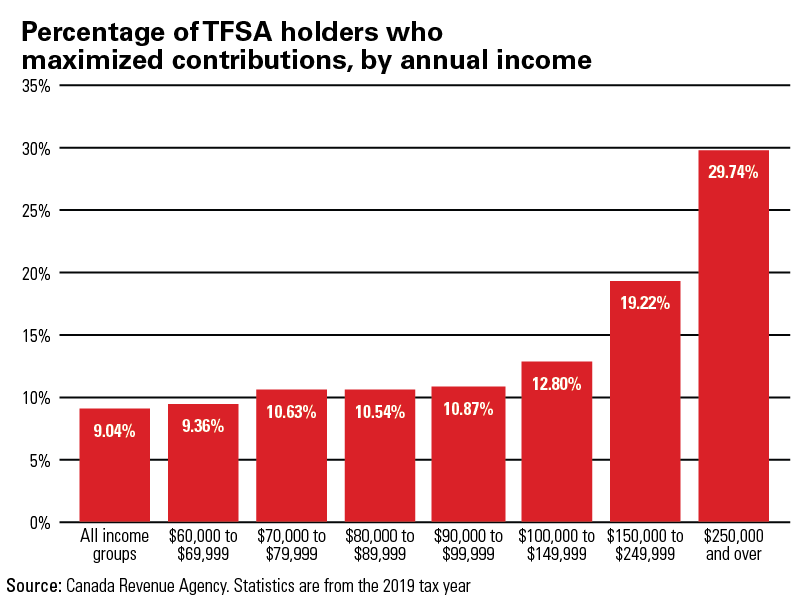

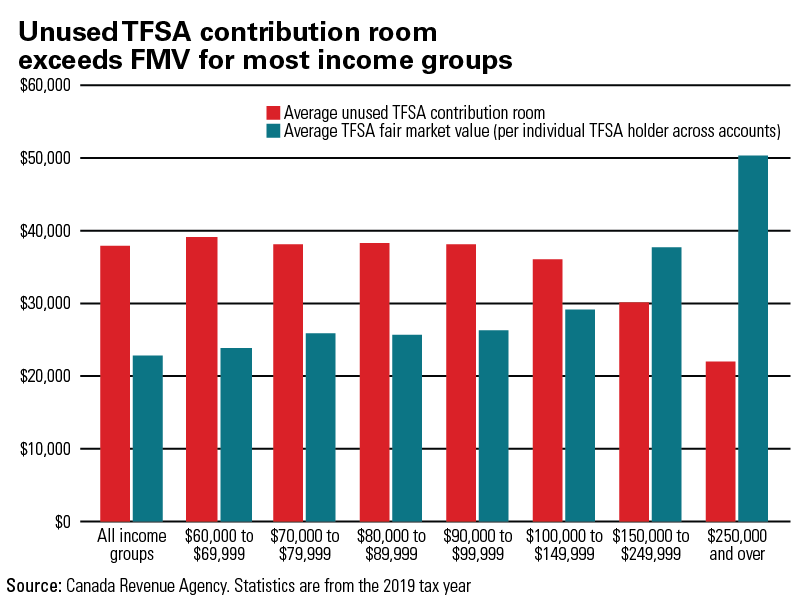

Plenty Of Tfsa Room Going Unused Investment Executive

2021 Canadian Federal Budget Top 5 Tax Measures Mccarthy Tetrault

Why Is Quebec S Income Tax The Highest In Canada Quora

Plenty Of Tfsa Room Going Unused Investment Executive

What A Year Without Clothes Did For Me

Income Tax 101 A Guide For Parents And Teens Mydoh

Tfsa Vs Rrsp Picking The Right One Could Save You 100 000 In Tax Planeasy